Health insurance in the United States is an essential component of everyday life for most Americans. With the high cost of medical care, insurance is the primary means of protecting individuals and families from financial devastation due to illness, injury, or other health-related issues. The healthcare system in the U.S. is complex, with multiple layers of private and public options, and navigating it can be challenging for many. However, the importance of having health insurance is undeniable, as it provides access to critical medical care and financial protection.

This article will explore the history and current state of health insurance in the U.S., its various types, the Affordable Care Act’s (ACA) role, and why health insurance is essential for the population. We will also discuss the challenges faced by uninsured individuals and potential reforms that could improve the system.

The History of Health Insurance in the U.S.

The U.S. healthcare system has evolved over the last century, shaped by various social, economic, and political factors. The origins of modern health insurance can be traced back to the early 20th century, but it wasn’t until the mid-1900s that health insurance became widespread.

1. Early Beginnings

In the early 1900s, health insurance was primarily offered through mutual aid societies and labor unions. These early plans were basic and only covered certain health conditions. However, during the Great Depression in the 1930s, health insurance began to gain more attention as medical costs rose and people were unable to afford care.

2. Post-WWII Growth

After World War II, employer-sponsored health insurance began to take off. Wage controls during the war led companies to offer health insurance as a benefit to attract workers, and tax incentives for employers further encouraged this practice. By the 1950s, employer-based insurance had become the norm for many working Americans.

3. Medicare and Medicaid

The creation of Medicare and Medicaid in 1965 marked a significant turning point in U.S. health insurance. Medicare provides health insurance to Americans aged 65 and older, while Medicaid serves low-income individuals and families. These programs are essential components of the public healthcare system and provide coverage to millions of Americans who would otherwise struggle to afford care.

4. The Affordable Care Act

The ACA, enacted in 2010, represents the most significant reform to the U.S. healthcare system in decades. It expanded access to health insurance, particularly for low- and middle-income Americans, through subsidies and the expansion of Medicaid. The ACA also introduced important consumer protections, such as preventing insurers from denying coverage based on pre-existing conditions and allowing young adults to stay on their parents’ insurance plans until age 26.

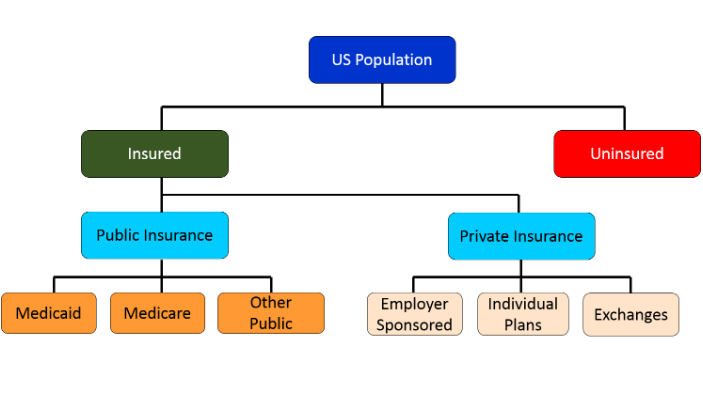

Types of Health Insurance in the U.S.

There are several types of health insurance available in the United States, each catering to different segments of the population. These include employer-sponsored insurance, government programs, and private insurance purchased on the individual market.

1. Employer-Sponsored Health Insurance

Most working Americans receive health insurance through their employers. Employer-sponsored plans vary widely in terms of coverage, cost, and benefits. Employers typically cover a significant portion of the premiums, making this an affordable option for many workers.

- Pros: Employer contributions reduce out-of-pocket costs; access to large provider networks.

- Cons: Limited choice of plans; loss of coverage if employment ends.

2. Medicare

Medicare is a federal health insurance program primarily for people aged 65 and older, though it also covers some younger individuals with disabilities. Medicare has several parts, including:

- Part A: Hospital insurance (covers inpatient hospital stays, hospice care, and some home health care).

- Part B: Medical insurance (covers doctor’s visits, outpatient care, and preventive services).

- Part C: Medicare Advantage (private insurance plans that bundle Parts A, B, and usually D).

- Part D: Prescription drug coverage.

- Pros: Broad access for seniors and people with disabilities; government-supported.

- Cons: Can have gaps in coverage, leading to the need for supplemental insurance.

3. Medicaid

Medicaid is a joint federal and state program that provides health coverage to low-income individuals and families. Eligibility varies by state, and the program covers a wide range of services, including doctor visits, hospital stays, long-term care, and more.

- Pros: Comprehensive coverage for low-income individuals; reduced or no out-of-pocket costs.

- Cons: Limited provider networks; eligibility varies by state.

4. Private Health Insurance

Individuals who do not receive employer-sponsored coverage or are not eligible for Medicare or Medicaid can purchase health insurance on the individual market. Plans are available through the Health Insurance Marketplace (established by the ACA) or directly from insurers.

- Pros: Flexibility to choose plans that suit individual needs; access to a wide variety of coverage options.

- Cons: Can be expensive without subsidies; coverage may be less comprehensive than employer plans.

5. Short-Term Health Insurance

Short-term health insurance plans are designed to provide temporary coverage, typically for periods of less than a year. These plans are often less expensive but offer limited benefits and do not cover pre-existing conditions.

- Pros: Lower premiums; useful for people in transition between jobs or waiting for other coverage to start.

- Cons: Limited coverage and benefits; may leave gaps in care.

Why Health Insurance Is Essential

Health insurance is crucial for both financial and health-related reasons. Without it, many Americans would be unable to afford necessary medical care, and even a minor illness could result in significant financial hardship.

1. Access to Medical Care

Health insurance provides access to preventive services, routine care, and emergency medical treatment. People with insurance are more likely to see a doctor for regular check-ups, which can prevent more serious health problems from developing. In the event of an illness or accident, health insurance ensures that individuals can receive the care they need without delay.

2. Financial Protection

One of the most important functions of health insurance is to protect individuals and families from the high costs of medical care. Without insurance, a hospital stay, surgery, or chronic illness could lead to medical bills amounting to thousands, if not hundreds of thousands, of dollars. Health insurance limits out-of-pocket costs through deductibles, copayments, and annual out-of-pocket maximums, reducing the financial burden on policyholders.

3. Mental and Emotional Well-Being

Knowing that you have health insurance can alleviate the anxiety of facing unexpected medical expenses. This peace of mind contributes to overall mental well-being, reducing the stress and worry that often accompanies health-related concerns.

The Impact of Being Uninsured

Despite the importance of health insurance, millions of Americans remain uninsured. Being uninsured can have serious consequences for individuals and society as a whole.

1. Limited Access to Care

Uninsured individuals are less likely to receive preventive care, routine screenings, and timely treatment for illnesses. Many avoid going to the doctor due to cost concerns, leading to delayed diagnoses and more advanced stages of disease. This not only affects individual health outcomes but also leads to higher healthcare costs when conditions become more difficult to treat.

2. Financial Hardship

Without insurance, even a simple medical procedure can lead to overwhelming debt. Many uninsured Americans struggle to pay medical bills, resulting in financial strain and, in some cases, bankruptcy. Medical debt is one of the leading causes of personal bankruptcy in the United States.

3. Wider Economic Impact

The uninsured population places a financial burden on the healthcare system. Hospitals and healthcare providers are often forced to absorb the costs of uncompensated care, which can lead to higher healthcare costs for everyone. Additionally, individuals without insurance may rely on emergency rooms for care, which is far more expensive than routine care provided in a doctor’s office or clinic.

The Affordable Care Act (ACA) and Its Role

The ACA, often referred to as “Obamacare,” was enacted in 2010 to address the issue of the uninsured population and the rising cost of healthcare. The ACA introduced several key provisions designed to make health insurance more accessible and affordable.

1. Individual Mandate

Initially, the ACA included an individual mandate, which required most Americans to have health insurance or pay a penalty. The mandate was intended to ensure that healthy individuals, not just those in need of care, would enroll in insurance, helping to balance the risk pool. However, the penalty for not having insurance was reduced to zero in 2019, effectively eliminating the mandate.

2. Medicaid Expansion

One of the most significant aspects of the ACA was the expansion of Medicaid to cover more low-income individuals. The expansion allowed states to extend coverage to adults with incomes up to 138% of the federal poverty level. However, not all states chose to expand Medicaid, leaving a coverage gap for millions of low-income Americans.

3. Health Insurance Marketplace

The ACA established the Health Insurance Marketplace, where individuals can compare and purchase private health insurance plans. Subsidies based on income are available to help lower the cost of premiums for individuals and families. The Marketplace has been a critical tool for expanding coverage to millions of previously uninsured Americans.

4. Protections for Pre-existing Conditions

Before the ACA, insurers could deny coverage or charge higher premiums to individuals with pre-existing conditions, such as cancer, diabetes, or heart disease. The ACA made it illegal for insurers to deny coverage based on health status, ensuring that people with pre-existing conditions can access affordable insurance.

Challenges and Areas for Improvement

While the ACA made significant strides in expanding coverage, there are still gaps and challenges in the U.S. healthcare system.

1. Rising Premiums and Deductibles

Despite the ACA’s efforts to make health insurance more affordable, many Americans still face rising premiums and high deductibles. For some, the cost of health insurance remains a barrier to accessing care, particularly for middle-income individuals who do not qualify for subsidies.

2. Medicaid Expansion Gaps

As of 2023, several states have yet to expand Medicaid, leaving millions of low-income individuals without coverage. These individuals fall into the “coverage gap,” earning too much to qualify for traditional Medicaid but too little to afford private insurance on the Marketplace.

3. Underinsurance

Even individuals with insurance may face challenges in accessing care due to high out-of-pocket costs. Many plans have high deductibles or limited coverage for certain services, leaving insured individuals vulnerable to financial hardship if they require extensive medical treatment.

Conclusion

Health insurance is a basic necessity for the population in the United States, providing access to medical care, financial protection, and peace of mind. The U.S. healthcare system has undergone significant changes over the years, particularly with the implementation of the Affordable Care Act. However, challenges remain, including rising costs, gaps in Medicaid coverage, and the persistent issue of underinsurance.

As healthcare continues to be a central issue in American politics, future reforms will likely focus on expanding access, reducing costs, and addressing the coverage gaps that still affect millions of Americans. In the meantime, for most Americans, having health insurance remains essential for navigating the complex and often expensive healthcare landscape.