Navigating the world of car insurance can be overwhelming, especially if you’re new to it. With a multitude of terms and options, understanding what you’re getting into is crucial for making informed decisions. Whether you’re purchasing your first policy or looking to brush up on your knowledge, knowing the key terms can help you better understand your coverage and ensure you’re getting the protection you need. Here’s a guide to ten essential car insurance terms you should know:

1. Premium

The premium is the amount you pay for your car insurance policy, typically on a monthly or annual basis. It’s essentially the cost of having insurance coverage. The amount of your premium can vary based on factors like your driving history, the type of vehicle you drive, your location, and even your credit score. Generally, higher coverage levels and additional features will increase your premium.

2. Deductible

Your deductible is the amount you must pay out of pocket before your insurance policy kicks in to cover a claim. For example, if you have a $500 deductible and you file a claim for $2,000, you’ll need to pay the first $500, and your insurance will cover the remaining $1,500. Choosing a higher deductible often results in a lower premium, but it means you’ll need to be prepared to pay more in the event of a claim.

3. Coverage Limits

Coverage limits refer to the maximum amount your insurance company will pay for a covered claim. There are usually two types of limits: per-person and per-accident. For instance, if you have a liability coverage limit of $100,000 per person, and you’re in an accident where multiple people are injured, your insurance will cover up to $100,000 for each injured person, up to the policy’s limit.

4. Liability Coverage

Liability coverage is a fundamental part of any car insurance policy and is required by law in most states. It helps cover costs if you’re found to be at fault in an accident, including damages to other vehicles, property, and medical expenses for other parties. Liability coverage typically includes bodily injury liability (for injuries to others) and property damage liability (for damage to others’ property).

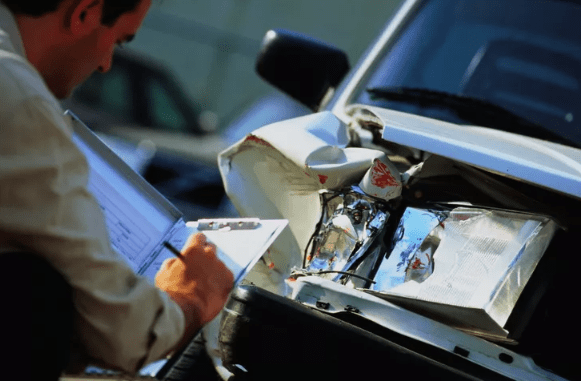

5. Collision Coverage

Collision coverage helps pay for repairs to your own vehicle after an accident, regardless of who was at fault. It’s especially useful if you have a newer or more valuable car that could be costly to repair. Collision coverage kicks in after you pay your deductible and covers damages resulting from collisions with other vehicles or objects.

6. Comprehensive Coverage

Comprehensive coverage provides protection against damages to your vehicle that aren’t the result of a collision. This includes damages from events such as theft, vandalism, natural disasters (like hurricanes or floods), and hitting an animal. Like collision coverage, it usually comes with a deductible, which you must pay before the insurance kicks in.

7. Uninsured/Underinsured Motorist Coverage

This type of coverage protects you if you’re in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover your damages. Uninsured/underinsured motorist coverage can help pay for your medical bills and repairs if you’re involved in an accident where the at-fault driver lacks sufficient coverage.

8. Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is also known as no-fault insurance. It covers medical expenses for you and your passengers regardless of who was at fault in an accident. PIP can also include coverage for lost wages, rehabilitation, and other related expenses. Not all states require PIP, but it can be particularly beneficial for covering medical costs and other expenses quickly.

9. Roadside Assistance

Roadside assistance is an optional coverage that provides help if your vehicle breaks down or you encounter other issues while driving, such as a flat tire or dead battery. Services typically include towing, jump-starts, tire changes, and fuel delivery. Adding roadside assistance to your policy can provide peace of mind, knowing help is just a phone call away if you need it.

10. Gap Insurance

Gap insurance is designed to cover the difference between what you owe on your car loan or lease and the actual cash value of your vehicle in the event of a total loss. If your car is totaled or stolen and you owe more on your loan than the car is worth, gap insurance helps pay off the remaining balance. This type of insurance is especially important for those who have recently purchased a new car or have a high loan balance relative to the car’s value.

Understanding the Basics

Understanding these key terms will give you a solid foundation in car insurance. Here’s a quick recap of what each term entails:

- Premium: The cost of your insurance policy.

- Deductible: The amount you pay out of pocket before insurance covers the rest.

- Coverage Limits: The maximum amount your insurance will pay for claims.

- Liability Coverage: Covers damages and injuries to others if you’re at fault.

- Collision Coverage: Pays for damage to your own vehicle after an accident.

- Comprehensive Coverage: Covers non-collision-related damages to your vehicle.

- Uninsured/Underinsured Motorist Coverage: Protects you if the other driver lacks sufficient insurance.

- Personal Injury Protection (PIP): Covers medical expenses and other costs regardless of fault.

- Roadside Assistance: Provides help with breakdowns and other roadside emergencies.

- Gap Insurance: Covers the difference between your car’s value and what you owe on your loan or lease.

Conclusion

Car insurance is a crucial part of responsible vehicle ownership, and understanding these terms will help you navigate your policy with greater ease. By familiarizing yourself with these concepts, you’ll be better equipped to choose the right coverage for your needs and make informed decisions when managing your policy. Whether you’re shopping for a new policy or reviewing your current one, these fundamental terms are the building blocks of a solid understanding of car insurance.