The job search process is often fraught with challenges, from crafting the perfect resume to acing interviews. However, one of the most significant, yet often overlooked, aspects of the job search is the role that healthcare insurance plays in shaping decisions and outcomes. In the United States, where health insurance is frequently tied to employment, job seekers must navigate a complex landscape where their health coverage can profoundly influence their career choices, job satisfaction, and overall well-being.

This article explores the intricate relationship between healthcare insurance and the job search, examining how health benefits influence job seekers’ decisions, the challenges faced by those who are unemployed or transitioning between jobs, and the broader implications for the labor market and public policy.

The Role of Healthcare Insurance in Job Decisions

Healthcare insurance is a critical factor in job decision-making for many Americans. Unlike in countries with universal healthcare systems, where health coverage is decoupled from employment, in the United States, job-based health insurance is a primary means of obtaining healthcare. This connection has far-reaching implications for job seekers and employees.

- Employer-Sponsored Health Insurance

Employer-sponsored health insurance is one of the most common forms of coverage in the United States, with many workers relying on their employers for health benefits. For job seekers, the availability and quality of health insurance offered by a potential employer can be a significant factor in deciding whether to accept a job offer. In some cases, especially for individuals with chronic health conditions or families to support, health insurance may outweigh other job-related factors, such as salary or location. Moreover, the cost of healthcare has steadily increased over the years, making employer-sponsored health insurance even more valuable. The potential out-of-pocket costs for health insurance premiums, deductibles, and copayments can be substantial, and the financial protection offered by a comprehensive employer-sponsored plan can be a major incentive for job seekers. - Job Lock

One of the key challenges associated with the linkage between healthcare insurance and employment is the phenomenon known as “job lock.” Job lock occurs when individuals remain in a job primarily because of the health benefits it provides, even if they are unhappy, underemployed, or have better opportunities elsewhere. This situation can limit career mobility and personal fulfillment, as workers feel compelled to stay in a position that offers necessary health coverage. Job lock can also have broader economic implications, as it may reduce overall productivity and innovation. When workers are unable to move freely between jobs, they may be less likely to pursue entrepreneurial ventures or seek positions that better match their skills and aspirations. This can result in a less dynamic labor market, with fewer opportunities for both employers and employees. - Health Insurance as a Competitive Advantage

For employers, offering competitive health insurance benefits can be a powerful tool for attracting and retaining top talent. In a tight labor market, where skilled workers are in high demand, health benefits can differentiate one employer from another. Companies that offer comprehensive health insurance, including coverage for dependents, mental health services, and wellness programs, are more likely to attract candidates who value these benefits. However, the rising cost of providing health insurance has also led some employers, particularly smaller businesses, to reduce the generosity of their benefits packages or shift more of the costs onto employees. This trend can affect job seekers’ perceptions of potential employers and influence their decisions about where to work.

Challenges Faced by Job Seekers Without Health Insurance

For those who are unemployed or transitioning between jobs, the loss or lack of healthcare insurance can add significant stress to the job search process. Uninsured job seekers face unique challenges that can impact their physical and mental health, financial security, and ability to find new employment.

- Gaps in Coverage

One of the most pressing issues for job seekers is the potential for gaps in health insurance coverage during periods of unemployment. While some individuals may qualify for continuation coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA), which allows them to keep their employer-sponsored insurance for a limited time, the cost of COBRA premiums is often prohibitively high, especially without a steady income. For those who do not qualify for COBRA or cannot afford it, the alternatives may include purchasing insurance through the Health Insurance Marketplace, enrolling in Medicaid if eligible, or going without coverage altogether. Each of these options has its drawbacks, from the complexity of navigating the Marketplace to the potential health risks associated with being uninsured. - Impact on Job Search Efforts

The absence of health insurance can also affect a job seeker’s ability to conduct an effective job search. Without insurance, individuals may delay or forgo necessary medical care, leading to worsening health conditions that can hinder their ability to actively pursue job opportunities. Chronic health issues, untreated due to lack of insurance, can reduce energy levels, increase stress, and lead to missed opportunities. Additionally, the financial strain of paying out-of-pocket for medical expenses can drain savings and increase anxiety, further complicating the job search process. Job seekers without insurance may feel pressured to accept a job offer quickly, even if it is not the best fit, simply to regain health coverage, which can lead to job dissatisfaction and a higher likelihood of turnover. - Mental Health and Well-Being

The stress of being uninsured, combined with the challenges of the job search, can take a toll on mental health. Anxiety and depression are common among job seekers, particularly those who are long-term unemployed or facing financial difficulties. The lack of access to mental health services, which are often covered by health insurance, can exacerbate these issues, creating a vicious cycle that makes it even harder to find and secure employment. Mental health challenges can also manifest in physical symptoms, such as sleep disturbances, headaches, and fatigue, further impacting a job seeker’s ability to present themselves effectively to potential employers. Without insurance, accessing necessary mental health support can be difficult, leaving many job seekers to cope with these challenges on their own.

The Broader Implications for the Labor Market

The relationship between healthcare insurance and job search extends beyond individual experiences to have broader implications for the labor market and public policy. Understanding these implications is crucial for policymakers, employers, and job seekers alike.

- Labor Market Mobility

As previously mentioned, job lock can reduce labor market mobility, preventing workers from pursuing new opportunities that could lead to better job matches, higher wages, and increased productivity. When workers feel trapped in their jobs due to the need for health insurance, it can stifle innovation and limit the overall dynamism of the labor market. Labor market mobility is essential for a healthy economy, as it allows workers to move into roles that better suit their skills and aspirations, leading to more efficient allocation of resources and greater overall economic growth. Reducing job lock by decoupling health insurance from employment, or by making health insurance more portable, could enhance labor market flexibility and benefit both workers and employers. - Income Inequality and Access to Healthcare

The current system of employer-sponsored health insurance contributes to income inequality, as access to quality health coverage is often tied to high-paying jobs or jobs with large employers. Low-income workers, part-time employees, and those working in the gig economy are less likely to have access to comprehensive health insurance, exacerbating disparities in health outcomes and financial stability. Addressing these inequalities requires policy interventions that ensure all workers have access to affordable health insurance, regardless of their employment status or income level. Expanding access to public health insurance programs, providing subsidies for low-income workers, or introducing universal healthcare coverage are potential solutions to these challenges. - Public Policy Considerations

The interplay between healthcare insurance and job search has significant implications for public policy. Policymakers must consider how health insurance policies impact labor market behavior, access to care, and economic security. Ensuring that all Americans have access to affordable health insurance, regardless of their employment status, is essential for promoting a healthy, dynamic labor market. Recent policy debates have focused on potential reforms to the healthcare system, including the introduction of a public option, expansion of Medicaid, or a shift towards a single-payer healthcare system. Each of these options has its pros and cons, but all aim to address the challenges posed by the current system, where health insurance is closely tied to employment. Additionally, policies that support job seekers during periods of unemployment, such as enhanced unemployment benefits, job training programs, and mental health services, can help mitigate the negative effects of losing health insurance during the job search process. By providing a stronger safety net, these policies can empower job seekers to take the time they need to find the right job, rather than rushing into a position simply to regain health coverage.

Conclusion

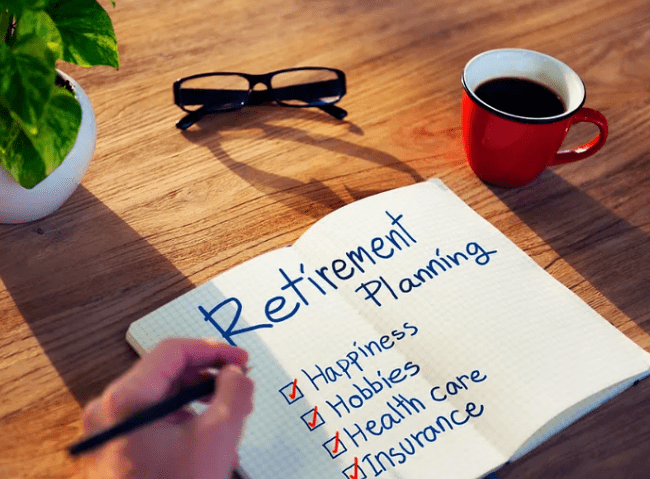

The relationship between healthcare insurance and the job search is complex and multifaceted, with significant implications for individuals, employers, and the broader economy. In a system where health insurance is closely tied to employment, job seekers must navigate a challenging landscape where the availability and quality of health benefits can influence their career decisions, job satisfaction, and overall well-being.

Addressing the challenges posed by this system requires a thoughtful approach that considers the needs of all workers, particularly those who are uninsured or underinsured. Policymakers, employers, and job seekers must work together to find solutions that ensure access to affordable healthcare, promote labor market mobility, and reduce income inequality.

As the healthcare landscape continues to evolve, it is essential to keep in mind the role that health insurance plays in shaping job search outcomes and the broader labor market. By addressing these issues head-on, we can create a system that supports both individual well-being and economic growth, ensuring that all Americans have the opportunity to pursue fulfilling careers without sacrificing their health or financial security.