Owning a unique vehicle, such as a classic car, recreational vehicle (RV), or hot rod, comes with a different set of responsibilities than owning a standard car. These vehicles often require specialized insurance to cover their specific needs and risks. Whether you own a vintage car that you only drive on weekends, an RV you use for cross-country trips, or a hot rod you’ve spent years customizing, the right insurance policy is crucial for protecting your investment.

This article explores the types of insurance you need for a classic car, RV, and hot rod, as well as what those policies cover to ensure your prized possession is protected.

Insurance for Classic Cars

What Is a Classic Car?

A classic car is typically defined as a vehicle that is at least 20–25 years old and has historical significance or rarity. Examples include vintage luxury cars, muscle cars, or antique cars that have been restored to their original condition. Classic cars are often highly valuable due to their rarity and the cost of restoration or maintenance.

Why Standard Auto Insurance Isn’t Enough

A standard auto insurance policy may not provide adequate coverage for a classic car. Here’s why:

- Value: Unlike regular cars, which depreciate over time, classic cars can appreciate in value. Standard insurance policies often calculate claims based on a car’s depreciated value, which would significantly undervalue a classic car.

- Usage: Classic cars are generally not used as daily drivers. Many owners take them out only on special occasions, for shows, or weekend leisure driving. Traditional insurance policies may not account for this limited usage.

- Specialized Repairs: Repairs and replacement parts for classic cars are often more expensive due to the rarity of parts and the specialized labor required.

What Type of Insurance Do You Need for a Classic Car?

Specialty insurers offer classic car insurance designed to protect the unique value and needs of vintage vehicles. Here are the key features of classic car insurance:

- Agreed Value Coverage: The most important feature of classic car insurance is agreed value coverage. With this type of policy, you and the insurer agree on the value of the car upfront, based on appraisals, market values, or receipts from restorations. In the event of a total loss, you receive the full agreed-upon value rather than a depreciated amount.

- Mileage Limits: Since most classic cars aren’t driven daily, insurance companies often impose mileage limits to reflect the limited use. Policies typically cover up to a certain number of miles per year, with options for occasional use, such as attending car shows or pleasure driving.

- Storage Coverage: Insurers often require classic cars to be stored in a secure location, such as a garage. Some policies offer coverage for theft, fire, or vandalism that may occur while the car is stored.

- Spare Parts Coverage: Restoring or maintaining a classic car often requires hard-to-find or custom parts. Some classic car policies include coverage for spare parts, protecting you from significant out-of-pocket expenses if something goes wrong.

- Roadside Assistance: Roadside assistance tailored for classic cars can cover specialized towing or roadside repairs, which may require a different approach compared to modern vehicles.

What Does Classic Car Insurance Cover?

- Collision and Comprehensive Coverage: Provides protection against accidents and non-collision-related damages like theft, fire, or weather-related events.

- Liability Coverage: Covers damages or injuries you cause to others if you’re at fault in an accident while driving your classic car.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re in an accident with someone who doesn’t have sufficient insurance to cover damages.

- Trip Interruption: Some policies offer coverage for travel expenses, such as lodging and transportation, if your classic car breaks down during a road trip.

Insurance for RVs (Recreational Vehicles)

What Is an RV?

An RV (Recreational Vehicle) is a motor vehicle or trailer equipped with living space and amenities found in a home, such as a kitchen, bathroom, and sleeping quarters. RVs come in various types, including motorhomes (Class A, B, and C) and towable trailers, like fifth-wheel campers and travel trailers. RVs are often used for long road trips or as temporary or full-time residences.

Why RV Insurance Is Different from Regular Car Insurance

RVs are more than just vehicles—they’re homes on wheels. Because of their dual purpose, RV insurance needs to cover not only the risks associated with driving but also the risks associated with living in the vehicle. A standard auto policy won’t cover all of the potential liabilities and losses that could occur with an RV.

What Type of Insurance Do You Need for an RV?

RVs require a specialized policy that offers both vehicle and property coverage. Here are the main features of RV insurance:

- Comprehensive and Collision Coverage: These cover your RV for damage caused by accidents or non-collision-related incidents, such as theft, fire, or natural disasters. For high-end motorhomes, this coverage is essential, as repairs can be costly.

- Liability Coverage: RV liability coverage is essential in case you cause damage or injuries to others in an accident. It works similarly to auto insurance liability coverage but may also extend to cover incidents that happen in the living area of your RV, such as someone slipping and falling inside the RV.

- Personal Belongings Coverage: Since many people use their RVs as homes, personal belongings like electronics, furniture, appliances, and clothing need to be insured. RV insurance provides coverage for these items, much like a homeowner’s or renter’s policy.

- Full-Time RV Insurance: If you live in your RV full-time, you may need full-time RV insurance, which offers more extensive coverage for personal liability, medical payments, and belongings. This type of insurance functions more like a combination of homeowners and auto insurance.

- Vacation Liability Coverage: If you only use your RV for vacations, vacation liability insurance provides coverage in case someone is injured while visiting your RV or while you’re parked at a campsite.

- Roadside Assistance: RV roadside assistance covers the cost of towing your RV to a repair facility, jump-starting the vehicle, changing flat tires, or providing lockout assistance. Since RVs are larger and more complex than regular cars, towing and repairs can be expensive, making this coverage especially important.

What Does RV Insurance Cover?

- Collision and Comprehensive Coverage: Covers damage to your RV from accidents or non-collision-related incidents such as fire, theft, or weather damage.

- Liability Coverage: Protects you if you’re at fault in an accident and responsible for damage or injuries to others.

- Medical Payments: Covers medical expenses for you and your passengers after an accident, regardless of fault.

- Personal Belongings: Covers loss or damage to personal items inside the RV, such as clothing, electronics, and appliances.

- Emergency Expenses: If your RV is damaged while you’re on a trip, some policies cover the cost of temporary lodging and transportation while repairs are made.

Insurance for Hot Rods

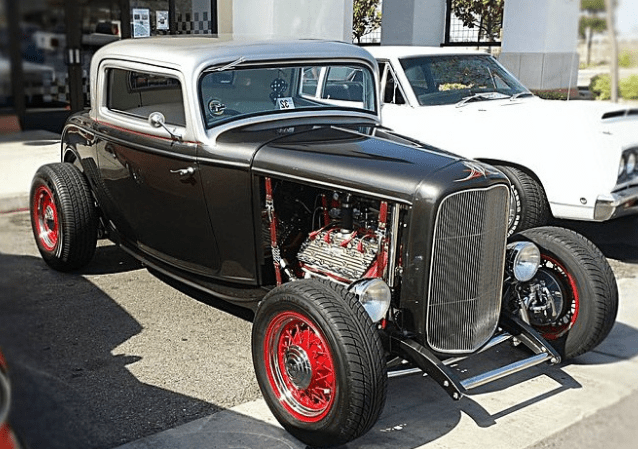

What Is a Hot Rod?

A hot rod is a custom-built or modified car, typically with enhanced performance features and aesthetic alterations. Hot rods are often classic cars that have been extensively customized with powerful engines, custom paint jobs, and other unique modifications. Due to their customized nature, hot rods are often more valuable than standard vehicles.

Why Hot Rods Need Special Insurance

Standard auto insurance may not provide adequate coverage for hot rods because of the modifications and customization involved. Custom parts and the time invested in building the car can significantly increase its value, and traditional policies may not recognize this added value.

What Type of Insurance Do You Need for a Hot Rod?

Hot rod owners need a specialized policy that reflects the custom nature of the vehicle. Key features of hot rod insurance include:

- Agreed Value Coverage: Like classic cars, hot rods should be insured with agreed value coverage. This ensures that you’re compensated for the full value of your customized car in case of a total loss. The agreed value is determined by mutual agreement between you and the insurer, often with the help of appraisals or receipts for custom work.

- Coverage for Custom Parts: Hot rod insurance policies typically include coverage for custom parts and modifications, such as custom paint jobs, performance engines, and specialty tires. Standard auto policies often exclude these types of modifications, leaving gaps in coverage.

- Limited Usage Coverage: Since hot rods are often driven less frequently and primarily for shows, events, or leisure, policies may include restrictions on mileage. Lower usage often translates to lower premiums, as the risk of accidents is reduced.

- Spare Parts Coverage: Many hot rod owners keep spare parts for repairs or future modifications. Some hot rod insurance policies offer coverage for these parts, protecting them from theft, fire, or other losses.

What Does Hot Rod Insurance Cover?

- Collision and Comprehensive Coverage: Covers damage to your hot rod from accidents or non-collision-related incidents like theft, fire, or weather damage.

- Liability Coverage: Protects you if you’re at fault in an accident and responsible for damages or injuries to others.

- Custom Parts and Equipment: Covers the cost of repairing or replacing custom parts and modifications.

- Agreed Value: In case of a total loss, the insurer pays the agreed-upon value of your hot rod, reflecting its full market value and custom work.

- Spare Parts: Some policies cover spare parts, ensuring that your investment in maintaining or upgrading the hot rod is protected.

Conclusion

Owning a classic car, RV, or hot rod comes with unique insurance requirements due to the distinct nature of these vehicles. Standard auto insurance policies often fall short in covering the full value and specialized risks associated with these vehicles. Specialty insurance policies provide the tailored coverage you need to protect your investment, offering features like agreed value coverage, personal belongings protection, and custom parts coverage.

Whether you’re an RV owner looking for full-time living coverage or a hot rod enthusiast seeking protection for custom modifications, understanding the specific insurance needs of your vehicle ensures that you’re fully covered and prepared for any unexpected events. By selecting the right policy, you can enjoy peace of mind knowing that your classic car, RV, or hot rod is protected both on the road and off.